Riggs Bank

The bank that helped fund the Mexican-American War and the purchase of Alaska met its downfall after helping Augusto Pinochet launder money.

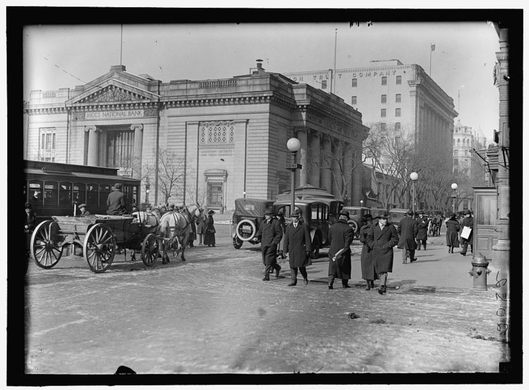

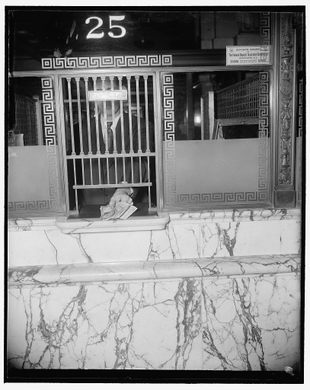

Riggs Bank was a Washington institution for over a hundred years. More than 20 U.S. Presidents—from Lincoln to Nixon—banked at Riggs, whose headquarters across the street from the Treasury Department was pictured on the back of the old $10 dollar bill.

In its golden age in the 19th century the bank financed Samuel Morse’s development, lent the federal government $16 million for the Mexican-American War, and supplied the funds to expand the capitol building and build the Washington Aqueduct system. Finally in 1865 it lent $7.2 million in gold to Secretary of State Sewell to purchase Alaska from Tsar Alexander II.

But this place at the center of power in Washington eventually led to some ugly business deals, which resulted in Riggs’ downfall in 2004.

Today, chances are that if you’re a native Washingtonian, you’ve walked by one of the former Riggs branches and not even known it. The iconic PNC banks in Dupont Circle and in Georgetown both used to be Riggs buildings. You can still faintly make out the outline of “Riggs National Bank” under the Dupont Branch Building’s brass lettering.

Trouble started brewing in the 1980s, when the CIA came to Riggs with a covert international affairs project. Working through the Saudi royal family (who banked at Riggs), the CIA provided funds to the Nicaraguan Contra rebels and the anti-Soviet Mujahideen in Afghanistan.

Riggs also had a more sinister relationship with Chilean dictator Augusto Pinochet. Senate hearings in 2004 shed light on to the ethically troubling story. Senator Carl Levin found that “In 1994, top Riggs officials traveled to Chile and asked General Pinochet, a notorious military leader accused of involvement with death squads, corruption, arms sales and drug trafficking if he would like to open an account at Riggs Bank here in Washington, DC. Mr. Pinochet said yes.”

Riggs was ultimately hit with $45 million in money laundering fines as a result of the scandal. Business went downhill quickly in the 2000s. The bank’s leadership was spending an inordinate amount of time pursuing embassy business that was prestigious, but “break even, or less,” according to PNC bank’s CFO. (At one point 95% of the foreign embassies in Washington banked with Riggs.)

The embassy business was high risk and had Riggs executives flying to client meetings around the world on an expensive corporate jet. The elegant Riggs buildings also became a liability, further adding to the bank’s high overhead. The scandals and debts continued to mount, and in 2004 Riggs was swallowed up by PNC Financial Services Group. The former Riggs Bank headquarters is now a publicly accessible Bank of America.

Follow us on Twitter to get the latest on the world's hidden wonders.

Like us on Facebook to get the latest on the world's hidden wonders.

Follow us on Twitter Like us on Facebook